Geopolitical Fault Lines: Analyzing the Profound Impact of the Russia-Ukraine Conflict on the CIS Region’s Economy and Trade Routes

1. Introduction: The CIS Region as a Geo-Economic Battleground

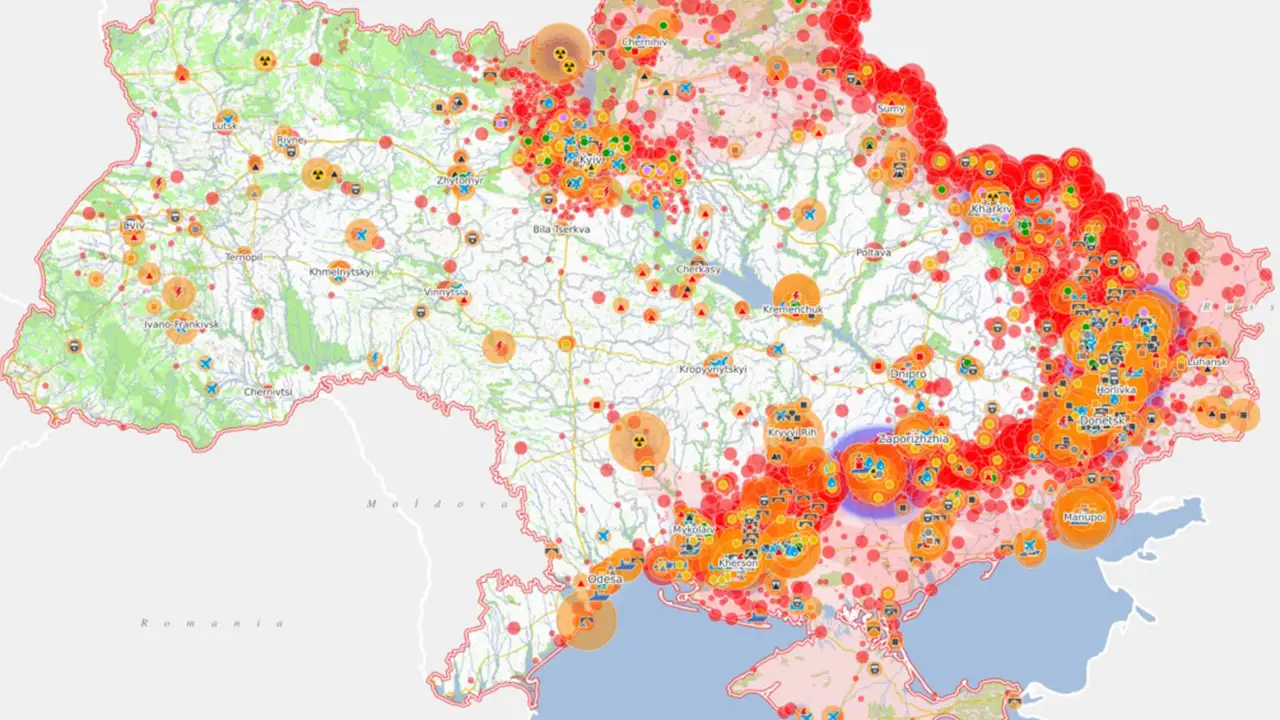

The armed conflict between Russia and Ukraine, commencing in February 2022, represents the most significant geopolitical shock to the global economy since the Cold War. While the initial impacts were felt globally through energy and food price spikes, the most fundamental and lasting structural damage has occurred within the Commonwealth of Independent States (CIS) and its adjacent Eurasian corridors. This region, defined by deep historical, economic, and logistical ties to Russia, now faces a complex fragmentation driven by Western sanctions, disrupted supply chains, and a desperate need for re-alignment.

For strategic international trade facilitators like Exim Company, operating across Eurasia, understanding this evolving landscape is crucial. Our role has transformed from merely executing transactions to providing critical risk mitigation, compliance assurance, and developing entirely new logistical and financial frameworks for our clients. This analysis delves into the economic upheaval, the shift in trade routes, and the strategic necessities for businesses navigating the new, highly volatile normal in the CIS region.

2. The Immediate Shockwaves: Sanctions, Energy, and Trade Disruption

The immediate aftermath of the conflict was characterized by a triple-pronged shock to the CIS economies:

A) Comprehensive Sanctions Regime: Western powers imposed unprecedented sanctions targeting the Russian financial system (e.g., SWIFT exclusion), technology sectors, and key individuals. This directly affected CIS members due to their reliance on Russian banking infrastructure and their position as significant trading partners. The sanctions created an immediate compliance nightmare for any international business engaging with the region.

B) Energy Market Turbulence: Russia’s central role as an energy supplier led to massive volatility in global oil and gas prices. While some CIS members benefited from higher commodity export revenues (e.g., oil and gas producers), consumer nations faced crippling energy inflation. The weaponization of energy forced European nations to seek new supply sources, diverting trade flows and re-prioritizing logistical networks globally.

C) Disrupted Transport and Insurance: Traditional Black Sea trade routes were severely compromised, rendering major ports unusable or high-risk. Furthermore, the withdrawal of major international shipping lines, freight forwarders, and global marine insurance providers created a logistical vacuum. The cost and complexity of insuring cargoes destined for the region skyrocketed, forcing traders to seek specialized risk management and logistics partners.

3. The Rise of Parallel Trade and Alternative Corridors

The sanctions regime created an immense commercial challenge: fulfilling market demand in Russia while complying with international restrictions. This environment necessitated the rapid development of “Parallel Trade” (often referred to as re-export or grey market activities) and the vital acceleration of the Middle Corridor (Trans-Caspian International Transport Route).

* Parallel Trade Mechanics: CIS nations, particularly Kazakhstan, Kyrgyzstan, and Armenia, became pivotal hubs for routing Western goods into Russia. These countries saw a massive increase in imports, often exceeding domestic consumption capacity, indicating transshipment activity. While legal under certain definitions, this requires specialized customs clearance and precise Country of Origin (COO) verification to manage legal exposure.

* The Middle Corridor’s Strategic Imperative: The Middle Corridor, connecting China, Central Asia, the Caucasus (Azerbaijan, Georgia), and Turkey, gained unparalleled strategic importance. This route, traversing the Caspian Sea, bypasses direct conflict zones and sanction risks.

* Exim Company’s Value: Our End-to-End Global Logistics specialization is now focused on optimizing this corridor, managing the complexity of multi-modal transfers (rail-to-sea-to-rail) and handling documentation across numerous jurisdictions efficiently. The ability to guarantee secure transfer through challenging geographies has become our key differentiator.

* Turkey and Iran as Hubs: Turkey and Iran have significantly amplified their roles as logistical and financial gateways to the CIS, leveraging their geographic positions to facilitate trade that avoids direct EU/US ports.

4. Commodity Dependence and Price Volatility

The CIS region remains highly dependent on a few key commodities, and the conflict has amplified market sensitivity and price volatility:

* Food Security (Grains): Ukraine and Russia are major exporters of wheat and sunflower oil. The disruption of Black Sea access created global food insecurity, directly affecting major importers in the Middle East and Africa. Trade flows for Foodstuff commodities have been forced through alternative, costlier routes (e.g., Danube River or Baltic ports), increasing the final cost to consumers.

* Fertilizers and Metals: Russia is a dominant global supplier of potash and certain metals (Nickel, Palladium). Sanctions and logistical issues have disrupted this supply, causing global price spikes that ripple through the manufacturing and agricultural sectors of CIS members and beyond.

* Capital Flight and Domestic Markets: Sanctions led to significant capital flight from Russia, coupled with extreme currency volatility (especially the Russian Ruble). This has hampered long-term investment and increased the cost of importing machinery and high-tech Industrial Parts for all economies linked to Russia.

5. Financial De-Dollarization and the Search for New Payment Systems

The severing of SWIFT access for major Russian banks posed an existential threat to trade in the region, accelerating a trend toward De-Dollarization.

* The Currency Shift: CIS nations and their primary trading partners (China, Turkey, Iran) are increasingly settling trades in local currencies (Ruble, Yuan, Lira) or non-Western currencies. This necessitates specialized expertise in managing foreign exchange risk and non-traditional payment mechanisms.

* New Financial Channels: Traders are relying more on smaller, regional banks not subject to major sanctions, or exploring innovative FinTech solutions for cross-border payments. Exim Company’s Integrated Financial Transfer Solutions are vital for providing compliant and reliable payment channels outside the traditional SWIFT network, offering clients a lifeline for commercial continuity.

* Insurance Challenges: As war risk premiums soar, standard International Cargo Insurance is often inadequate. Exim Company must provide bespoke risk mitigation strategies that may involve government-backed insurance programs or specialized regional carriers to protect the high value of transshipped goods.

6. Long-Term Structural Changes: Divergence vs. Integration

The conflict is driving two opposing long-term trends within the CIS:

* Divergence: Some CIS members are actively seeking to reduce their economic reliance on Russia, primarily by strengthening ties with China, Turkey, and Europe (where possible). This requires massive investment in infrastructure linking their nations to the Middle Corridor and alternative global ports.

* Deeper Integration: Conversely, the necessity of trade survival for some has fostered deeper reliance on the newly constructed economic bloc that includes Russia, Iran, and certain Central Asian partners, facilitating parallel trade and shared financial infrastructure.

The ultimate outcome will be a multi-speed CIS region, requiring traders to possess Regional Risk Management Expertise tailored to each country’s specific geopolitical positioning.

7. Strategic Opportunities for Trade Facilitators

For a firm with a comprehensive service model like Exim Company, the turbulence is manageable and presents significant opportunity:

* The Compliance Edge: Our expertise in Professional Customs & Compliance transforms a major headache for clients into a core competitive advantage, ensuring uninterrupted trade flow amidst sanctions and regulatory flux.

* The Logistical Master Key: By mastering the complexities of the Middle Corridor and managing End-to-End Global Logistics across challenging borders (especially the Caspian crossings), we offer guaranteed delivery where others fail.

* Financial Continuity: Our ability to execute Integrated Financial Transfer Solutions provides the necessary transactional lubrication for trade otherwise paralyzed by traditional banking restrictions.

The market now demands reliability and compliance above all else. Exim Company is positioned not just as a trader, but as the essential architect of compliant and resilient trade networks in the evolving CIS economy.

8. Conclusion: Navigating the New Normal

The Russia-Ukraine conflict has permanently fractured the established trade norms within the CIS. The region is now characterized by heightened risk, fragmented financial systems, and shifting trade priorities. Survival demands agility, specialized expertise, and a commitment to regulatory excellence. By leveraging its integrated services in logistics, finance, and compliance, Exim Company is uniquely prepared to help international clients manage complexity, minimize exposure, and strategically capitalize on the new geopolitical realities of the Eurasian corridor.

Need a resilient trade pathway in the CIS region?