The Middle Corridor’s New Reality: Optimizing Logistics and Risk Management on the Trans-Caspian Route for Resilient Trade

1. Introduction: The Geopolitical Imperative from the Arabian Gulf

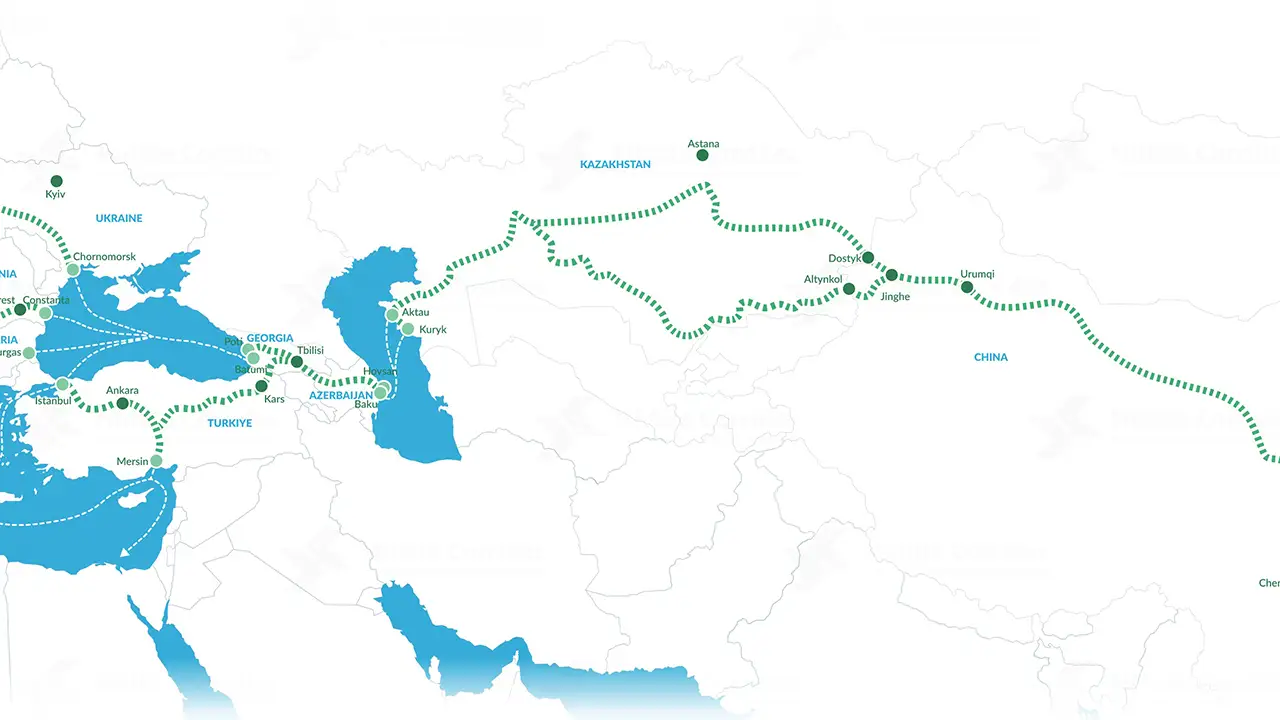

The Middle Corridor (Trans-Caspian International Transport Route – TITR), traversing from China through Central Asia, the Caspian Sea, the Caucasus, and Turkey, has surged from a supplementary route to a geopolitical imperative. Amidst the persistent sanctions against Russia and widespread supply chain disruption, the TITR offers a vital, sanctions-compliant artery linking East and West, effectively bypassing the traditional Northern route.

For international trade facilitators, and especially for companies like Exim Company, strategically headquartered in Dubai, UAE, mastering this corridor is the key to providing supply chain continuity. Dubai’s position as a global transshipment and financial hub—particularly through Jebel Ali Port and its sophisticated Free Zones—makes it an indispensable partner in the operational success of the Middle Corridor. This analysis examines the current bottlenecks, the required investment, and the strategic advantages of leveraging the TITR for future Eurasian trade stability, specifically through the vantage point of the Arabian Gulf.

2. Deconstructing the Middle Corridor: Route Mechanics and Stakeholders

The TITR is not a single, unified route but a complex network of multi-modal links involving rail, ports, and sea crossings. It is a critical component of China’s Belt and Road Initiative (BRI) and serves as the most viable East-West connection for goods destined for Central Asia, the Caucasus, and onward to Europe, bypassing direct Russian territory.

* Key Segments: The route typically involves rail from China, crossing Kazakhstan, a crucial sea leg across the Caspian Sea (to ports like Baku in Azerbaijan or Aktau/Kuryk in Kazakhstan), and further rail travel through Georgia and into Turkey or via the Black Sea.

* The Dubai Connection: Dubai’s role is two-fold:

* Maritime Feeder: Dubai’s Jebel Ali port acts as the primary gateway for cargo originating from Asia (India, Southeast Asia) that is then re-exported into the Middle Corridor via land connections or smaller vessels.

* Financial and Compliance Hub: As a globally recognized financial center, Dubai facilitates complex local currency settlements and manages the necessary compliance checks for goods destined for CIS nations, providing a secure, Western-aligned financial channel.

3. Strategic Bottlenecks: Infrastructure, Capacity, and Sea Crossings

Despite its strategic value, the Middle Corridor is currently constrained by operational and structural limitations that require specialized logistical management.

3.1. Caspian Sea Chokepoint: Port Capacity and Ferry Limitations

The most significant bottleneck remains the Caspian Sea crossing. The infrastructure—including the ports of Baku (Azerbaijan), Aktau, and Kuryk (Kazakhstan)—was not initially designed for the current surge in container volumes.

* Ferry Dependency: The reliance on rail-ferry services across the Caspian is highly dependent on weather and vessel availability. Turnaround times can be unpredictable, directly impacting the overall transit reliability of the corridor.

* Investment Needs: Major investments are underway in port digitalization, crane capacity, and the acquisition of new, larger ferry fleets, which will be essential to meet the 10x growth targets projected for the route.

3.2. Standardization Challenges: Gauge Differences and Customs Harmonization

International rail movement is complicated by the change in rail gauge (the distance between rails). Cargo entering China must adapt to the standard gauge, while the CIS region uses the broader Russian gauge.

* Transloading Requirement: This necessitates mandatory transloading (transferring containers between different types of trains) at border points (e.g., the China-Kazakhstan border), which is a time-consuming and cost-intensive process.

* Customs Complexity: Moving cargo through multiple sovereign customs territories (China, Kazakhstan, Azerbaijan, Georgia, Turkey) requires highly synchronized documentation. The lack of fully harmonized digital customs procedures across all nations adds significant complexity and risk of delay.

3.3. Geopolitical Risks and Security on the Route

While the corridor is generally safer than direct conflict zones, its path runs through several politically sensitive areas. Financial institutions and insurers view the route with caution, driving up the cost of International Cargo Insurance and trade finance. The stability of key transit countries (such as Georgia and Azerbaijan) is constantly monitored by global traders.

4. The Cost Equation: Time, Tariffs, and the Pricing of Reliability

The Middle Corridor is generally slower than the traditional Russian land route and more expensive than sea freight, but its value proposition is reliability and compliance.

* Time vs. Money: Transit time is typically 15-25 days from China to Turkey/Europe, significantly faster than 45-60 days by sea but slower than the 10-14 days previously offered by the northern route. Customers pay a premium for this time saving and, more critically, for sanctions compliance.

* Tariff and Fee Structure: Costs are compounded by the multiple transshipments, sea legs, and administrative fees imposed by each transit country’s railway system. Managing these variable tariffs requires sophisticated financial modeling and supply chain optimization to offer competitive pricing.

* The Dubai Re-Export Premium: Goods moved from Dubai into the Middle Corridor often enjoy Free Zone benefits that allow the deferral or elimination of duties, provided the goods are legally re-exported. This is a crucial advantage for high-value items and industrial components.

5. Exim Company’s Blueprint: Mastering the Trans-Caspian Trade from Dubai

Exim Company leverages its Dubai headquarters and integrated expertise to transform the complexities of the Middle Corridor into a competitive advantage for clients.

5.1. Multi-Modal Logistics and Optimized Route Planning

Our team specializes in managing the intricate multi-modal handovers required by the TITR.

* Jebel Ali Integration: We seamlessly manage the transfer of cargo arriving at Jebel Ali, often from Asia/India, and dispatch it via land and rail connections toward the Caspian ports. This direct management minimizes local handoff risks.

* Predictive Scheduling: Utilizing data analytics, we provide predictive scheduling that accounts for ferry capacity and weather conditions, offering clients the most realistic transit times. Our contracts with ferry operators and railway companies ensure priority allocation of scarce capacity.

5.2. Specialized Customs and Compliance Management

Given the high volume of parallel trade and the strict compliance requirements for goods entering the CIS region, our Professional Customs & Compliance desk is essential.

* End-to-End Documentation: We manage all documentation, ensuring that Country of Origin (COO) rules are strictly adhered to, particularly for goods that may be routed through the UAE’s Free Zones. This prevents legal exposure in destination markets.

* Inter-Customs Coordination: We proactively manage documentation across all transit borders (Kazakhstan, Azerbaijan, Georgia), utilizing digital platforms where available to secure faster clearance and minimize border dwell time, which is crucial for sensitive cargo like Foodstuff.

5.3. Integrated Financial Solutions for Corridor Transactions

Operating out of Dubai allows us to provide secure, non-USD financial solutions that bypass sanction risks.

* Local Currency Settlement: We structure transactions using currencies like the Chinese Yuan (CNY), UAE Dirham (AED), or regional currencies, utilizing our trusted network of regional banks that maintain compliance while avoiding the Western financial net.

* Risk Protection: Our International Cargo Insurance is specifically tailored to cover war risk and political instability in the transit nations, offering a level of asset protection that standard global insurers often exclude.

6. Conclusion: The Middle Corridor as the Future of Eurasian Trade

The Middle Corridor represents a defining strategic artery for the future of Eurasian trade, driven not by choice, but by geopolitical necessity. While challenges related to infrastructure and customs harmonization persist, the route offers reliability, compliance, and a vital link between global manufacturers and the CIS markets.

Exim Company, strategically positioned in Dubai, is uniquely equipped to manage the inherent complexities of the TITR. By integrating superior logistics management, rigorous customs compliance, and secure financial transfers, we transform this challenging geopolitical pathway into a predictable, efficient, and profitable route for our clients. In the new era of trade, mastering the Middle Corridor is not just a logistical capability—it is a strategic commercial mandate.

Ready to secure your supply chain via the Middle Corridor? Leverage Exim Company’s Dubai-based expertise.